Taxation of interest on Provident Fund in Budget 2021-22 - A discussion

- rohitkparmar

- Feb 6, 2021

- 8 min read

Updated: Aug 20, 2021

Taxation of interest on Provident Fund in Budget 2021-22 - A discussion

Rohit Kumar Parmar Free lance 1

IES (Retd)

Former Senior Economic Adviser

Ministry of Consumer Affairs, Food and Public Distribution

I. Introduction

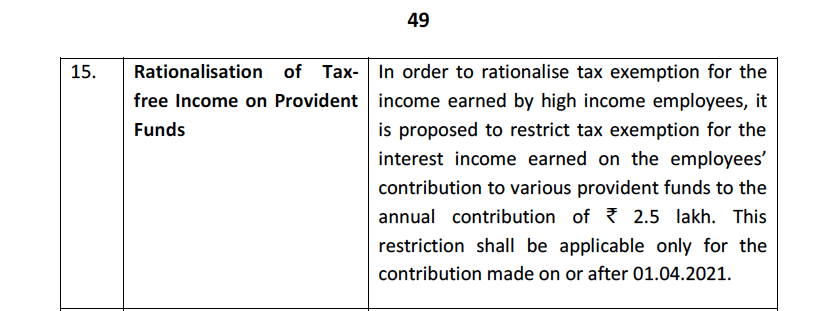

Towards increasing tax revenues from existing tax payers, adopting the use of the phrase `Rationalization of tax-free Income on Provident Funds’, Budget 2021-22 is `to restrict tax exemption for the interest income earned on the employees’ contribution to various provident funds to the annual contribution of Rs. 2.5 lakhs’. Snapshot of point 15 of Annex to part B of Budget Speech 2021-22 `Direct Tax Proposals’ is pasted below.

The background to introduction of income tax on interest income on provident fund of high income employees in the name of rationalization of tax-free Income on Provident Funds, is discussed in the following paragraphs.

II. Rationalization of tax exemptions

An efficient tax system aims to maximise revenue, at least cost to different players – the tax collector, tax payer, tax facilitator and the economy, which (the economy) slows down if the tax system is too regressive. Rationalisation of a tax system could include any/all of the following

i. low/lower rates of taxation

ii. fewer tax slabs

iii. fewer exemptions

iv. neutralisation for price increases, to ensure that real incomes are not eroded

v. administrative ease of compliance through lesser discretion

vi. simplicity and transparency, including in compliance

vii. simple return forms and process of filing.

In the above background, all taxation thresholds, exemptions should build in equity in respect of duration and associated levies/benefits. All tax exempt investments of similar/same duration should offer the same incentives, including in the (exempt) EEE groupings- the first E -investment stage; second E -interest/earning stage; and third E -withdrawal stage. Contributions/investments of same duration should have the same tax liability - year of accrual, or the year of withdrawal or at the option of the assessee. Similarly, tax exempt contributions/investments should also be subject to the same TDS rules and treatment.

There was/is a need to rationalize tax exemptions by simplifying them and bringing in equity across different segments of tax payers, especially in the three (exempt) EEE groupings. However, it is debatable whether the action to restrict tax exemption for the interest income earned on the employees’ contribution to various provident funds to the annual contribution of Rs. 2.5 lakhs can be classified as rationalisation. It creates another category for contributions to PFs in excess of Rs. 2.5 lakhs.

Suggestions on rationalization of exemptions based on the equity argument, including by this author [1] were made prior to budget 2021-22, which do not appear to have been considered/found favour. An analysis of the decision to restrict tax exemption for the interest income earned on the employees’ annual contributions to PFs above Rs. 2.5 lakhs follows.

III. Levy of tax on interest on PF contributions above Rs. 2.5 lakhs

IT Returns have been collecting data on exempt/interest income. The Tax Research Unit (TRU)/ Task force on Direct Tax code has made good use of this data to suggest removing part of interest income (earned from PF contributions above Rs. 2.5 lakhs) from the list of exemptions and bring it within the tax ambit. This is a good example of data mining at work, albeit for a few assessees.

Possible implications of the proposed changes to restrict tax exemption for the interest income earned on provident funds to the annual contribution of Rs. 2.5 lakhs are discussed below. The purpose of the discussion is to address issues likely to arise in the implementation of the same.

III. 1 Basis of tax, associated discrimination

The proposed restriction on tax exemption is possibly the first example of income tax being levied on a criteria indirectly related to income in the year it is taxed, and is arrived when the ceiling of Rs. 2.5 lakhs is breached in the contribution to Provident Funds, in an earlier year. This creates an inequity as explained below.

Individual A can have an interest income from all his PF accounts higher than individual B, but will not pay any tax since he has in no year contributed more than Rs. 2.5 lakhs. This amounts to discrimination against individual B on a criteria other than income (contribution) during the financial/assessment year. There is need to consider changes to bring in equity.

III. 2 Removal in part of the second Exemption E

The proposed restriction on tax exemption for the interest income earned on provident funds to the annual contribution of Rs. 2.5 lakhs, removes in part the second Exemption E, albeit for those who contribute more than Rs. 2.5 lakhs in the PFs. Accordingly, exemption at the second stage on interest/earnings for investment above Rs. 2.5 lakhs is withdrawn/ends/restricted. The tax is to apply to earnings from PFs in excess of Rs. 2.5 lakhs made after April 1, 2021, i.e. assessment year 2022-23, after which the impact of the same shall be available for analysis.

Earnings on contributions to PF in excess of Rs. 2.5 lakhs (PF is social security) will be less remunerative and assessees may consider shifting to options which do not enjoy the second E. Since the ceiling of relief of Rs. 1.5 lakhs stands exhausted such assesses may also consider shifting to other investments that are unrelated to tax concessions like RBI/other bonds/instruments. The benefit that accrues to the provider/player, when a government decision diverts investment is that of a captive market and continued flow of resources, so that they can offer lower returns. Accordingly, respective players providing them would benefit by getting cheaper funds.

III. 3 Little rationale for equating investment in PF having a tenure of over 20 years, with investment of durations of 5 years

As stated earlier, the proposed step will bring contributions to PF (in excess of Rs. 2.5 lakhs) at par with investments/instruments not enjoying the second E. Equating contributions to PF, which (with some exceptions) is available only on superannuation, having a tenure of over 20 years, with investments/instruments of durations of 5 years is iniquitous and has no rationale, as observed below.

`Nothing is so unequal as the equal treatment of unequals.’ (Thomas Jefferson, paraphrasing Aristotle).

This principle is also upheld in several judgments of the Supreme Court of India including in Air India v. Nergesh Meerza and others [(1981) 4 SCC 335],

III. 4 Exemption under Section 80 C subject to a ceiling of Rs. 1.5 lakhs

It is important to highlight that contributions to PF (as part of the overall limit of Rs. 1.5 lakhs) beyond Rs. 1.5 lakhs (in aggregate) do not receive any investment benefit as first E. The individual who contributes to the PF (beyond Rs. 1.5 lakhs in aggregate) does not receive tax relief as first E. Taxing his second E beyond Rs 2.5 lakhs limit brings the assessee at par with a category, to which he does not belong, as earlier explained.

The contribution in excess of Rs. 1.5 lakhs by the assessee (is saving for reasons other than tax -building a house, education or marriage of children, saving for his old age, medical emergency, reduction in interest rates, tax surge) in a secure product, in the absence of social security, would now be subject to tax and so a pruning of returns, making him further vulnerable.

III. 5 Additional Rs. 50,000 available for NPS should be extended to PF contribution

The proposed restriction on tax exemption for the interest income earned on provident funds to the annual contribution of Rs. 2.5 lakhs by doing away with the second E (beyond Rs. 1.5 lakhs in aggregate), brings it at par with the NPS, which enjoys an additional Rs. 50,000 at the first E stage. The Budget Speech 2021-22 is, however, silent as to whether the additional Rs. 50,000 will be available to PF contributions at the first E stage.

Government may consider the additional Rs. 50,000 to all contributions to PFs. It is re-iterated that this is not the best solution to the same.

III. 6 Need to coordinate deposits in two/ more PF accounts

Contributions to PFs can change (increase or decrease) in any year. What happens when the contribution changes in the next/subsequent/alternate year. This will necessarily imply maintaining separate accounts. An account (first taxable) where contribution is more than Rs. 2.5 lakhs and the (second non-taxable) account where contribution is less than Rs. 2.5 lakhs or vice-versa. However, whether an amount can be treated as the first or second type account can be ascertained after contributions during the financial year are closed.

Those who work in the private sector would confirm (or deny is few cases) that in any year because of change of a job, there could be two/more provident fund accounts, since the process of closure and transfer of accounts could take time. How and who would decide the total contribution to PFs exceed Rs. 2.5 lakhs in a given financial year? This decision may also need to be ratified by the income tax authorities at some stage. There is a need to link all PF accounts of an individual through a PAN/other identity number.

The existence of more than one account will further complicate the system, adding cost of maintenance of separate accounts, which should be factored in and possibly compensated by the exchequer.

III. 7 Need to clarification for PPF/ Government Provident fund/ other Provident Fund accounts

Contributions to PPF are subject to a ceiling of Rs. 1.5 lakhs, which may also be increased to Rs. 2.5 lakhs to bring in equity. The ceiling of Rs. 1.5 lakhs was revised in 2014.

A clarification is needed on whether PPF/ Government Provident Fund/ Other Provident Funds are to be included, when the restriction of Rs. 2.5 lakhs is to be calculated.

III. 8 Tax on interest on the amount in excess of Rs. 2,50,000

To provide equity, tax should be levied on the interest earned on the amount in excess of Rs. 2.5 lakhs and not the entire amount. This will entail maintaining separate records from the PF account till the stage of filing/acceptance of return. Necessary instructions/ clarifications on this are required.

III. 9 Form of levy of tax

There is need to clarify on the year in which the tax liability will be levied - the year of accrual; or the year of withdrawal; or will the assessee have an option of the year in which the tax would be levied. This decision should also factor in – whether there is TDS. Not doing so will create a situation where TDS is levied in the year of accrual, even though payment is made on maturity in the case of bank deposits putting them (bank deposits) to a disadvantage vis-à-vis other investments.

III. 10 Irony of the decision

As part of Atma-Nirbhar Bharat, government decided to pick up the tab of employers contribution to PF in several cases, which is now being transferred to high income employees. The irony of the decision is that high income employees (large share of which is employees of government, public sector and autonomous bodies) will be made to pay for the largesse to the corporate sector.

IV. Suggestions

To sum up, the following may be considered.

i. The proposed changes are iniquitous and there is need to bring in equity.

ii. Government may consider extending the additional Rs. 50,000 exemption as in NPS, to all contributions to PFs. It is re-iterated that this is not the best solution to the same.

iii. There is a need to link all PF accounts of an individual through a PAN identity number to monitor the contribution to PFs.

iv. To provide equity, tax should be levied on the interest earned on the amount in excess of Rs. 2.5 lakhs and not the entire amount.

v. There is need to clarify on the year in which the tax liability will be levied - the year of accrual; or the year of withdrawal.

vi. The ideal solution is to restrict the contribution to all PFs to Rs. 2.5 lakhs leaving the assessee to seek investments that are unrelated to tax concessions like RBI/other bonds/instruments.

vii. Contributions to PPF are subject to a ceiling of Rs. 1.5 lakhs, which may also be increased to Rs. 2.5 lakhs to bring in equity.

Comments